Note: This is a printed version of https://isc.uw.edu/pslf. Please visit this page on the ISC website to ensure you're referencing the most current information.

ISC

Public Service Loan Forgiveness (PSLF) Form Completion Requests

Last updated Monday, April 22, 2024

Using Federal Student Aid’s PSLF Help Tool

While the Payroll Office cannot provide support for Federal Student Aid’s PSLF Help Tool, it’s important to note the following:

- We strongly recommend reviewing Federal Student Aid’s Become a Public Service Loan Forgiveness (PSLF) Help Tool Ninja page BEFORE using their PSLF Help Tool.

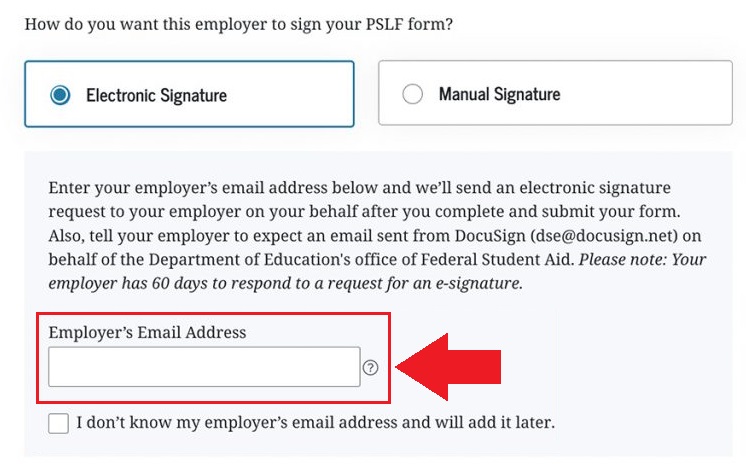

- In the PSLF Help Tool, when you select completion of your form via an electronic signature, you will be prompted to provide the UW’s email address. You MUST enter pslf@uw.edu in the field highlighted in the screenshot at the right (click to enlarge).

Specifying any other address in the Employer’s Email Address field will impact the Payroll Office’s ability to complete your PSLF form in a timely manner.

Submit a Request Without Using the PSLF Help Tool

To determine who you should contact to complete your PSLF form, make a selection below.